Besides being a general pain in the ass, moving residences can also be exceptionally expensive. There are many costs and fees that go into securing a new place. In addition to the time and emotional energy, tenants must also pay up front many non-refundable fees like application fees, pet fees, parking passes, and security deposits. These fees are usually on top of the other expenses, such as the costs of setting up new utilities, storage units, professional cleaning, and renting a truck to move personal belongings.

Security deposits where renters give a bond worth one or two month’s rent to their landlord to be held as a security against damages and lease non-performance can be a real burden for some renters. In particular, these high deposits (estimated to be worth a total of $45 billion in the U.S.) in have been known to make it harder for individuals to escape bad situations, such as a domestic violence issue or get out of predatory debt from credit cards or medical bills. Security deposits are also another example of why it costs more to be poor since landlords usually ask people with low credit scores, convictions, or past evictions (people more likely to be poor already) to pay higher deposits to justify their risks. That money is then held in a bank account earning minimal interest by the landlord until the lease ends — keeping tenants from using that money to better their lives in the meantime.

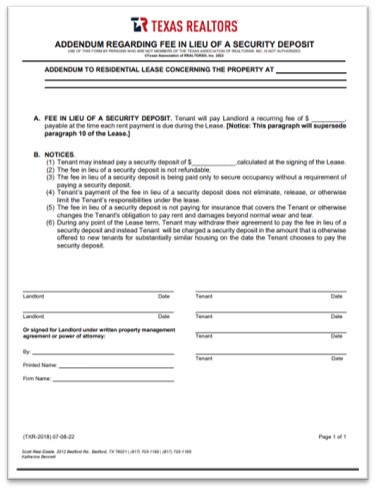

A slate of jurisdictions have passed new laws in recent years, including Texas’ SB 1783 in 2021, that allow property owners to charge monthly fees instead of requiring security deposits up front. This is good news for tenants as it means they need less up front cash to move into a new property. The bad news for renters is that this is a fee instead of a deposit so the tenant will not be entitled to receive any of those funds back when they move. Under the Texas law, the tenant is allowed to switch from a monthly fee to a traditional refundable security deposit at any time (so long as this transaction is done in writing). Landlords are not allowed to use the tenant’s use of of this fee vs. a security deposit as a factor when deciding upon potential new residents. The Texas Realtors have published a new form for landlords to use if their tenant chooses the non-security deposit route.

The monthly fee paid by the tenant is to go toward the landlord taking out an insurance policy (often called security deposit replacement products or SDRs) that will pay out damages if the tenant damages the property beyond basic wear and tear or fails to pay rent. The monthly fee charged by landlords should be within the range of the monthly rate for one of these policies. While costs of these products vary depending on the SDR company used, the National Housing Law Project estimates these costs to be between $96 and $242 for a policy on a 12-month lease on a property renting for $1,400.

Although landlords are not allowed to charge tenants for costs the landlord recovers from the SDR, the laws for these products are new and not as well established as traditional security deposit rules, which may leave tenants vulnerable unscrupulous landlords. Plus, the SDR companies will usually go after the tenant for to repay any funds that insurance company had to pay on the tenant’s behalf. As the policy is taken out on the tenant by the landlord, the tenant may become financial liable for claims paid out on damages that did not occur (for example, a landlord could call an insurance company and report that Tenant X moved out and broke all the windows. Tenant X may have left the property in good condition and have no idea about the landlord’s claim until much later when the insurance company came after Tenant X to collect the money the company paid to fix all the windows).

Fortunately, landlords and tenants are not required to use these products. Many people may find they are more comfortable with the status quo until rules and regulations protecting both parties become more established. In the meantime, some individuals may want to try these products and see for themselves. If you do, please report back. I’d love to hear your personal experience.

I have not personally used one of these products yet, but here are a few of the companies that are currently in the market:

Leave a Reply