With it formally being the season known as getting all my files together to do my taxes, I’m reminded of all the technology solutions I use that in our business. It turns out there a lot of them.

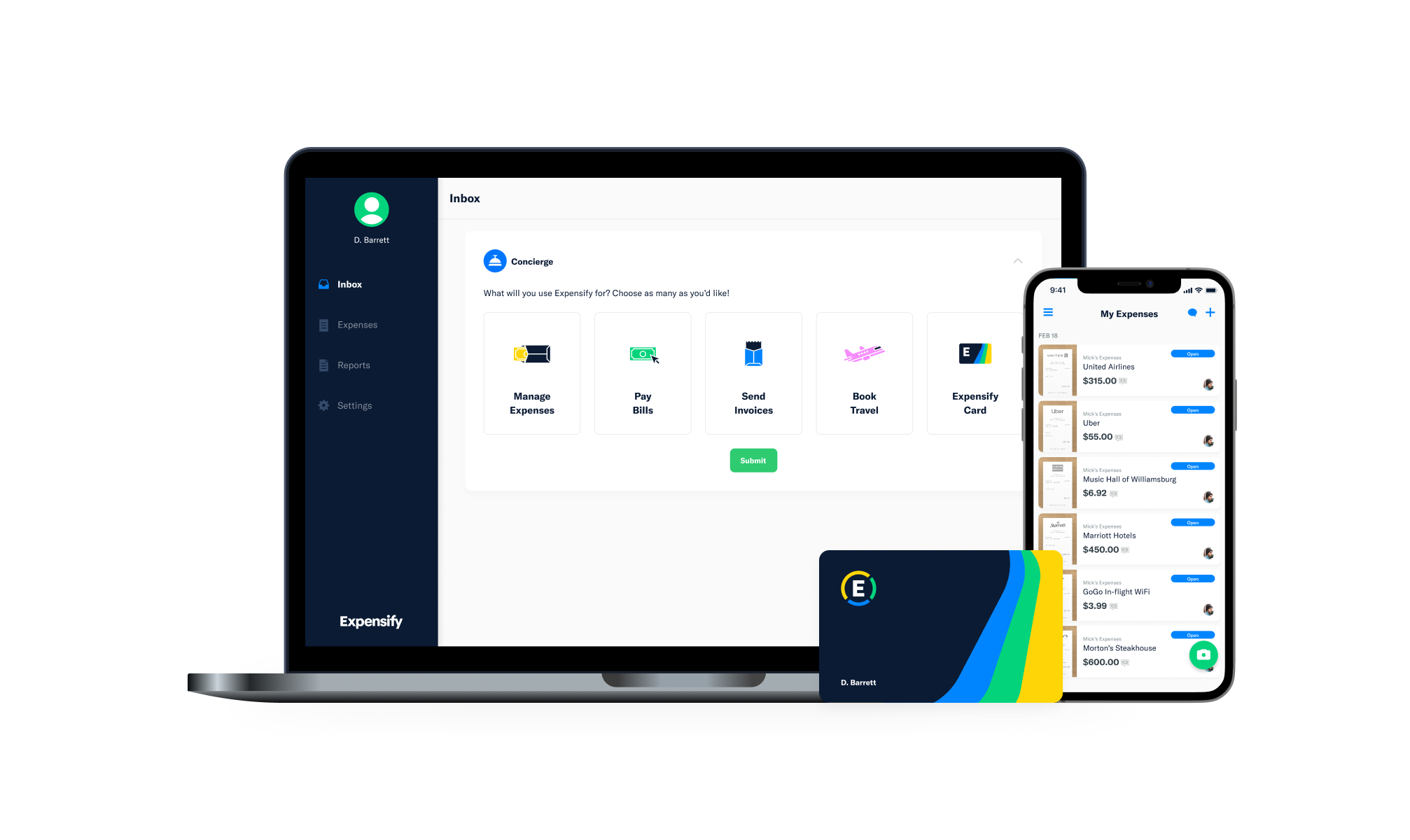

My favorite tool for keeping up with all my receipts is Expensify. At this point, I honestly don’t know how I’d keep up with any of my receipts without it. The program (which is free) lets me forward any by e-mail any digital receipt to my account. I can also  take a picture with my phone and capture receipts that way. Once they’re into my account, I can sort them by property or account. It even lets me sort by vendor. This has been helpful when generating 1090 for our main vendors. I also use this to find receipts for warranty information. I just used this to find a receipt for a dishwasher to have it serviced under warranty. There is also a way to set up automated tasks. For example, I have a trash vendor on autopay. So once I get that receipt into the program, it automatically adds it to the report I have for that address. At the end of the year, I can then export a .csv file and pull it into Excel for the accountant. This year-end reporting also gives us a chance to reflect on the year as a whole and think about any strategic decisions going forward, such as a need to raise a rent to keep up with expenses, a need for a larger repair, or consider whether it makes sense to sell an asset.

take a picture with my phone and capture receipts that way. Once they’re into my account, I can sort them by property or account. It even lets me sort by vendor. This has been helpful when generating 1090 for our main vendors. I also use this to find receipts for warranty information. I just used this to find a receipt for a dishwasher to have it serviced under warranty. There is also a way to set up automated tasks. For example, I have a trash vendor on autopay. So once I get that receipt into the program, it automatically adds it to the report I have for that address. At the end of the year, I can then export a .csv file and pull it into Excel for the accountant. This year-end reporting also gives us a chance to reflect on the year as a whole and think about any strategic decisions going forward, such as a need to raise a rent to keep up with expenses, a need for a larger repair, or consider whether it makes sense to sell an asset.

Another important piece of reporting investors need to track is their mileage expenses. The mileage reimbursement rate is currently $.625. Depending on how much you drive for the business, this can really add up. I use an app on my phone call MileIQ. The app integrates with the Bluetooth and GPS features in my phone and to detect what car I’m driving and where I’m going. At the end of the month (or whenever we get around to it), we go in and classify whether a drive was for business or personal. If it’s a regular route (such as visiting a property regularly), you can set up a rule so that drives from your home to that address are automatically classified as being business related. This app isn’t free though. It’s $5.99 a month. There are probably free apps like this out there, but this one works for us.

For our short-term rental, the two main technology tools we use to market and lease our properties are Airbnb and VRBO. Both platforms allow us to market our properties, connect with guests, and receive fees. Both also have reporting tools that allow us to see how much guests paid and the fees and taxes retained by the platforms. There are pros and cons to both, but they generally work about the same way in terms of allowing an export of data for year-end analysis. Related to these platforms is another technology tool called TurnoverBNB. This is the app that we use to schedule and pay our cleaning service. The platform takes a small commission for their service, but we’ve found it worthwhile for scheduling with our crew. I also like the reporting services to tally up how much we spent on cleaning. I also like to use Google Calendar for syncing all the dates occupied at the short-term rental with my other calendars. I preferred using the iPhone calendar, but I found it wouldn’t sync with Airbnb and VRBO so I made the switch.

When thinking about technology, often overlooked is the role of social media when it comes to real estate investing. I personally like to use Facebook when it comes to sharing a property available for rent. Their marketplace feature makes it easy to post the listing and share it. I also like to go into the “Buy, Sell, Trade” groups affiliated with the specific neighborhoods where the property for rent is listed and share the advertisement there. I find people who live in a specific area are often looking to move but stay in the area. Or they have a local friend that is in the market. In the past, I would also list a house for rent on Zillow, but the company has messed around with the pricing so much I don’t use it as much any more. I have tinkers with Craigslist and MilitaryByOwner, but Facebook is what’s working the best at the moment.

Once I do have a person interested in renting, I have them complete their rental application online at MySmartMove. Using this program, the potential tenant pays a fee directly to this company (owed by the credit agency TransUnion) which runs a credit, criminal and eviction report on the person and sends me a broad overview of whether they’re a good fit for the property based on the proposed rent. Although I love this program, I also ask the person to complete a rental application in a Word document. MySmartMove will tell me their credit worthiness, but it doesn’t give me much personal information on the person, such as the names and ages of all the occupants, pets, former addresses, references and who to contact in an emergency. Pricing for this service is usually about $40 and I have the person pay it directly to the service (owned by TransUnion) rather than give their application fee directly to me.

Also for tenant screening I use a program called TruthFinder. This is a program that searches for information on individuals and addresses. I use this in conjunction with MySmartMove to do a brief search of a potential tenant to look for patterns in their history. I also sometimes use this to look up a potential vendor just to get a better idea of who I am dealing with. I also find once or twice a year I go into and look up my tenants to see if anything new or interesting pops up that may be worth knowing. As they say, knowledge is power and I know to know who I’m going to entrust with an expensive asset. This program costs me about $250 a year.

Once I have my tenant, I like to use Apartments.com to keep track of leases and payments. Previously I used a program called Cozy.co, but it was acquired by Apartments.com in 2018 and integrated with a bigger product made more for managers of larger multifamily units rather than small property managers like myself. However, over time they have worked through some of the kinks and it’s gotten to be a good product for my needs. I like that I’m able to set up a property in their system and share all the lease documents with my tenants. Tenants are then allowed to pay their rent directly through the system — simplifying my reporting. Some of my tenants prefer to pay still through Venmo or Zelle (my philosophy is to take their rent however is easiest for the tenant to ensure we get paid). In that case, Apartments.com lets me update their record with an “offline” payment. I can also set up the system to allow automatic late fees or any other one-time assessments, like a pet fee for a tenant getting a dog in the middle of lease. Like other programs, it has a reporting feature so I can track how much rent was collected for each unit during the year. Expensify-PR_Assets

Leave a Reply